PAN-Aadhaar Linking: Aadhaar and PAN Card linking deadline is 31 December 2025, and it is extremely important for every Indian citizen to complete this process on time. If you fail to link your Aadhaar and PAN by the last date, your PAN will become inoperative from 1 January 2026. This means you will not be able to file your Income Tax Return (ITR), you won’t receive tax refunds, your salary credit may get affected, and even your SIP investments can fail due to an inactive PAN.

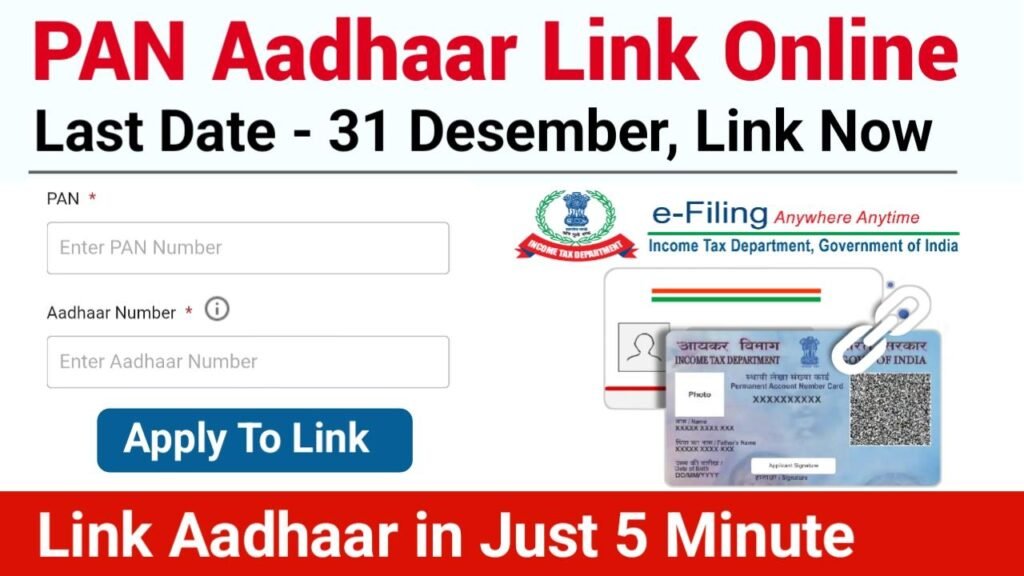

Best part is that you don’t need to visit any office to complete this process. You can easily link your Aadhaar with your PAN online from comfort of your home. The government has provided a simple and quick method for linking through official income tax portal. Below is complete step-by-step process to help you finish Aadhaar-PAN linking without any hassle.

How to Link Aadhaar with PAN? Complete Step by Step Process

You can easily link your PAN Card with your Aadhaar through official Income Tax Department website.

- First, visit the Income Tax e-filing portal https://www.incometax.gov.in/iec/foportal/ .

- On homepage, you will see option “Link Aadhaar” , then click on it.

- Enter your PAN number, Aadhaar number, and mobile number.

- After submitting the details, you will receive an OTP on your mobile , then Enter the OTP to verify.

- If your PAN is already inoperative, you must first pay a fee of 1000 Rupees.

- After completing the steps, go to “Quick Links” “Link Aadhaar Status” to check whether your Aadhaar-PAN linking is successful.

Who Needs to Link Aadhaar and PAN by December 31?

To promote transparency and accountability in tax filing, Central Board of Direct Taxes (CBDT) has made Aadhaar–PAN linking mandatory. This linkage is essential for filing your Income Tax Return (ITR). Anyone who has been issued a PAN card on or before 1 October 2025 must ensure that their Aadhaar is linked with their PAN by 31 December 2025.

If this deadline is missed, PAN will become inoperative from 1 January 2026, which can lead to several issues in tax filing and financial transactions.

What Happens If You Don’t Link Aadhaar with PAN?

- If you do not link your Aadhaar and PAN by 31 December, your Income Tax Return (ITR) cannot be filed or verified.

- Your tax refund will be stopped, and any pending returns will not be processed.

- Form 26AS will not show TDS/TCS credit, which may affect your tax calculations.

- TDS/TCS may also be deducted or collected at higher rates, causing financial loss.

- After you complete Aadhaar-PAN linking later, your PAN usually becomes operative again within 30 days.